Quick Start Tradomate Screener Backtesting

The Screener Backtest in Tradomate is designed to let traders test their screening ideas against historical data - bridging the gap between stock discovery and strategy validation. Instead of just finding stocks that fit your rules today, the Screener Backtest shows you how those rules would have performed in the past.

This helps you measure profitability, consistency, and risk before committing capital, so you can trade with confidence.

Walkthrough video

Section titled “Walkthrough video”Whether you use simple filters or advanced multi-condition rules, the Screener Backtest instantly runs them over years of market data, delivering insights on returns, hit rates, drawdowns, and more.

Running your first backtest on Tradomate is simple. Follow the video below to learn how to validate your stock screens using the AI-powered Screener Backtest:

Step-by-step guide to running a Screener Backtest

Section titled “Step-by-step guide to running a Screener Backtest”Here’s a step-by-step guide to help you run backtesting on a screen -

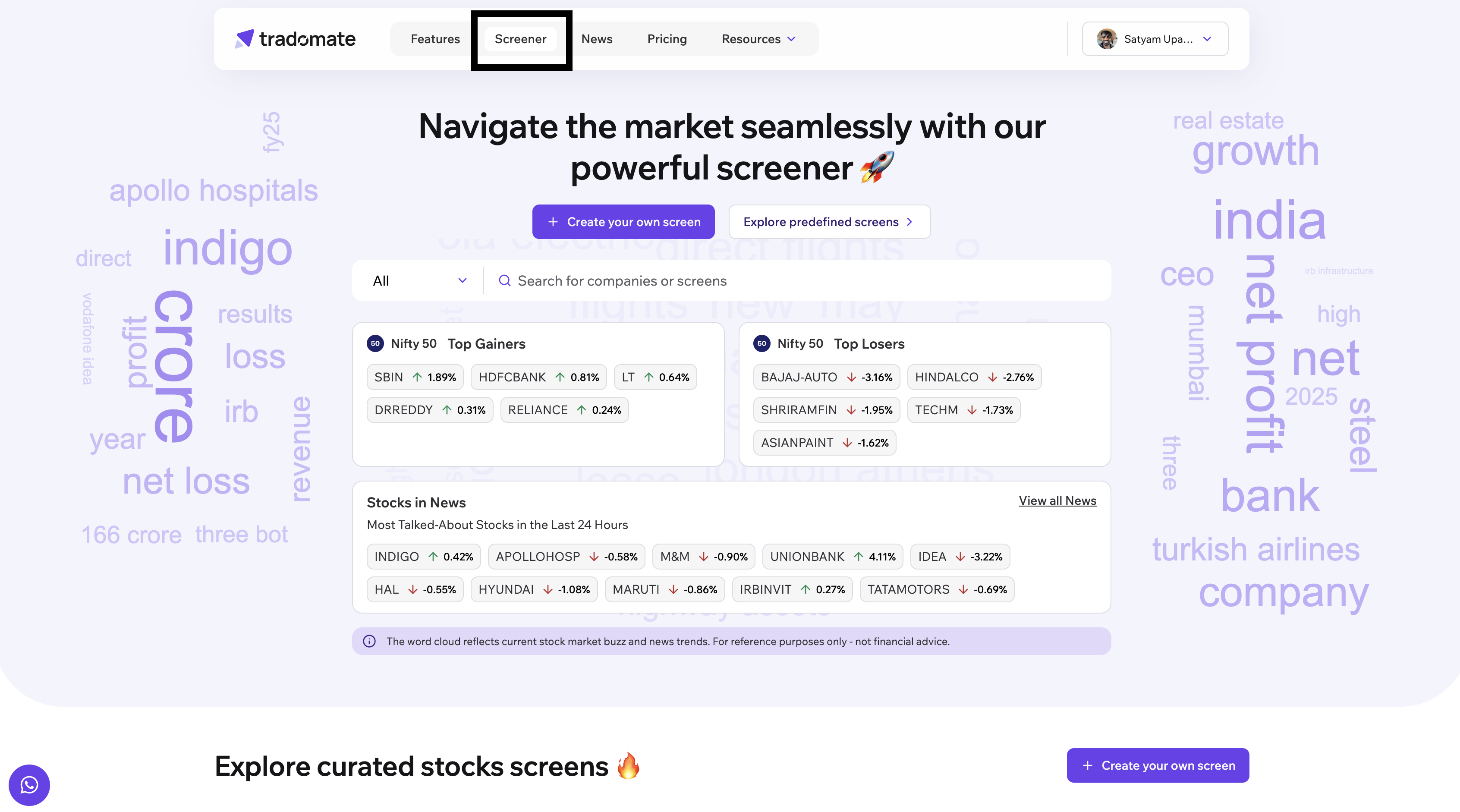

Login and Tradomate Screener homepage

Section titled “Login and Tradomate Screener homepage”Visit the Tradomate.one platform and log in using your phone number.

Once logged in, Navigate to the Screener section from the top navigation bar.

Here you can see the market pulse at a glance with the Top Gainers and Top Losers in nifty50, the stocks that are in News, and the media talk via Wordcloud. You can choose from your saved screens or start with one of the predefined screens available on the platform.

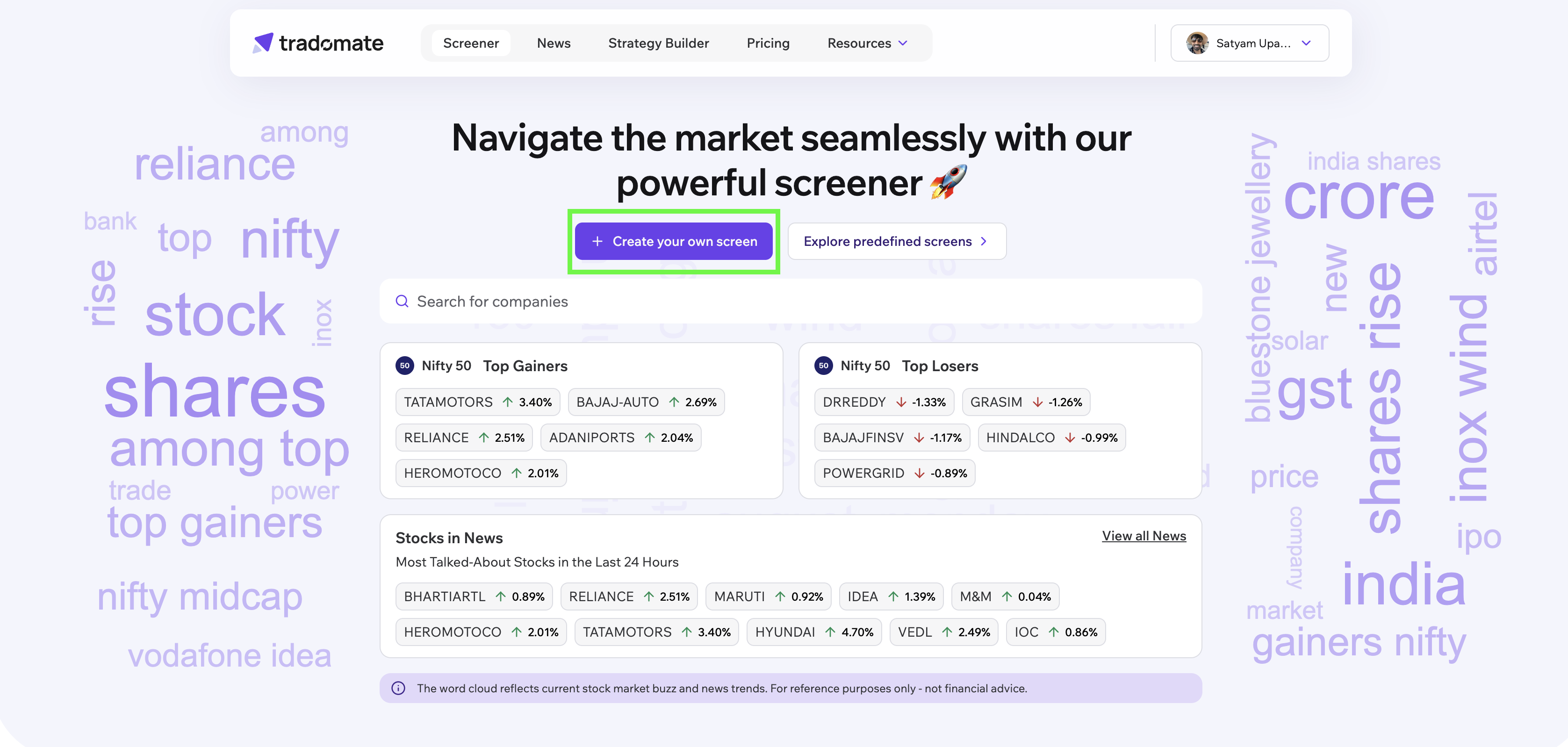

Let’s start with creating our own screen.

To create a custom screen, click on Create your own screen on the screener landing page.

Custom screen creation

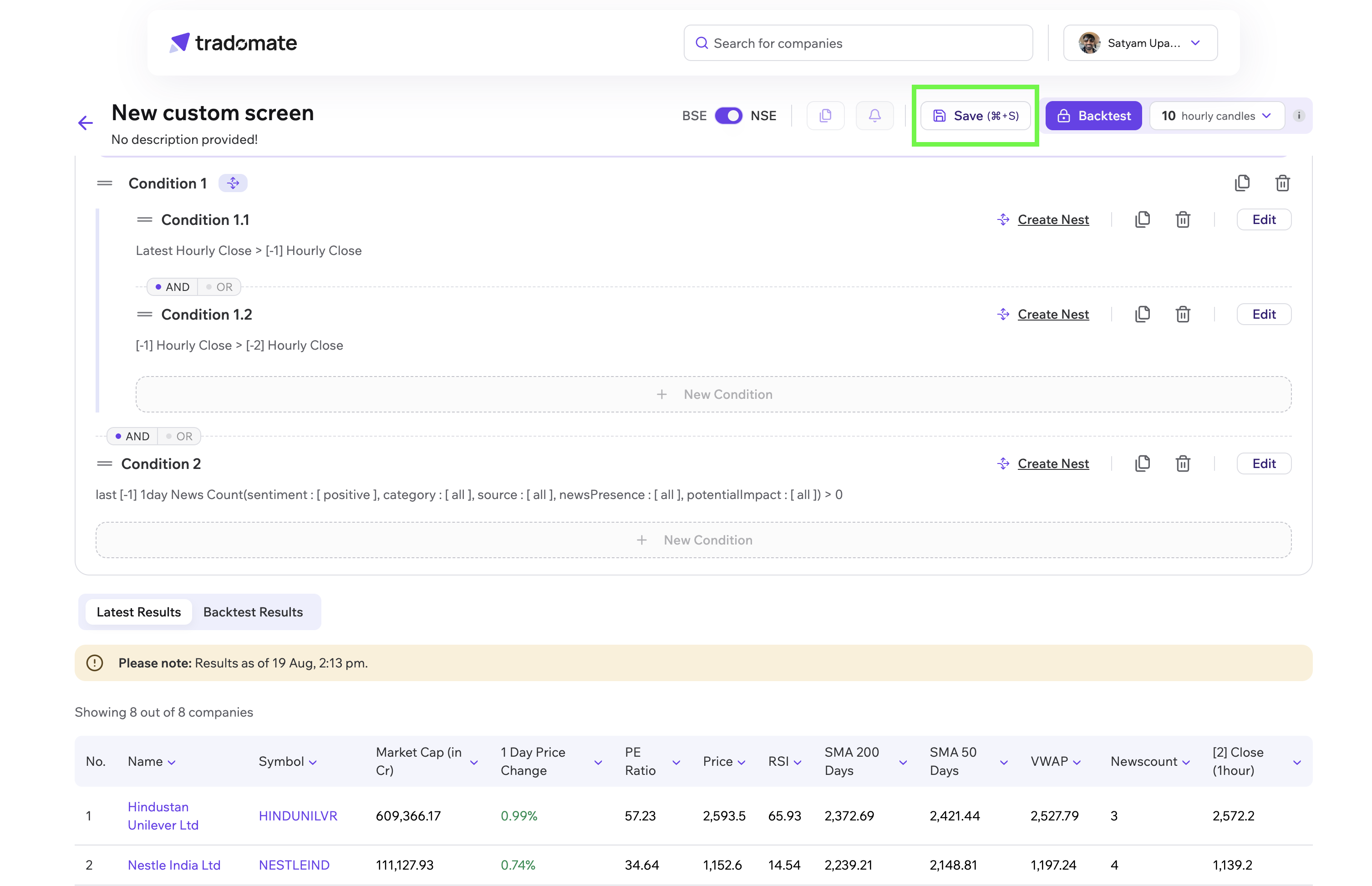

Section titled “Custom screen creation”Let’s say we want to look for stocks that are uptrending in the last 2 hours and have a positive news since yesterday.

All we need to do is write this sentence in simple text and press enter to create the rules.

Once the rules are created, press the run filter button to see results for this query.

Screener Backtesting

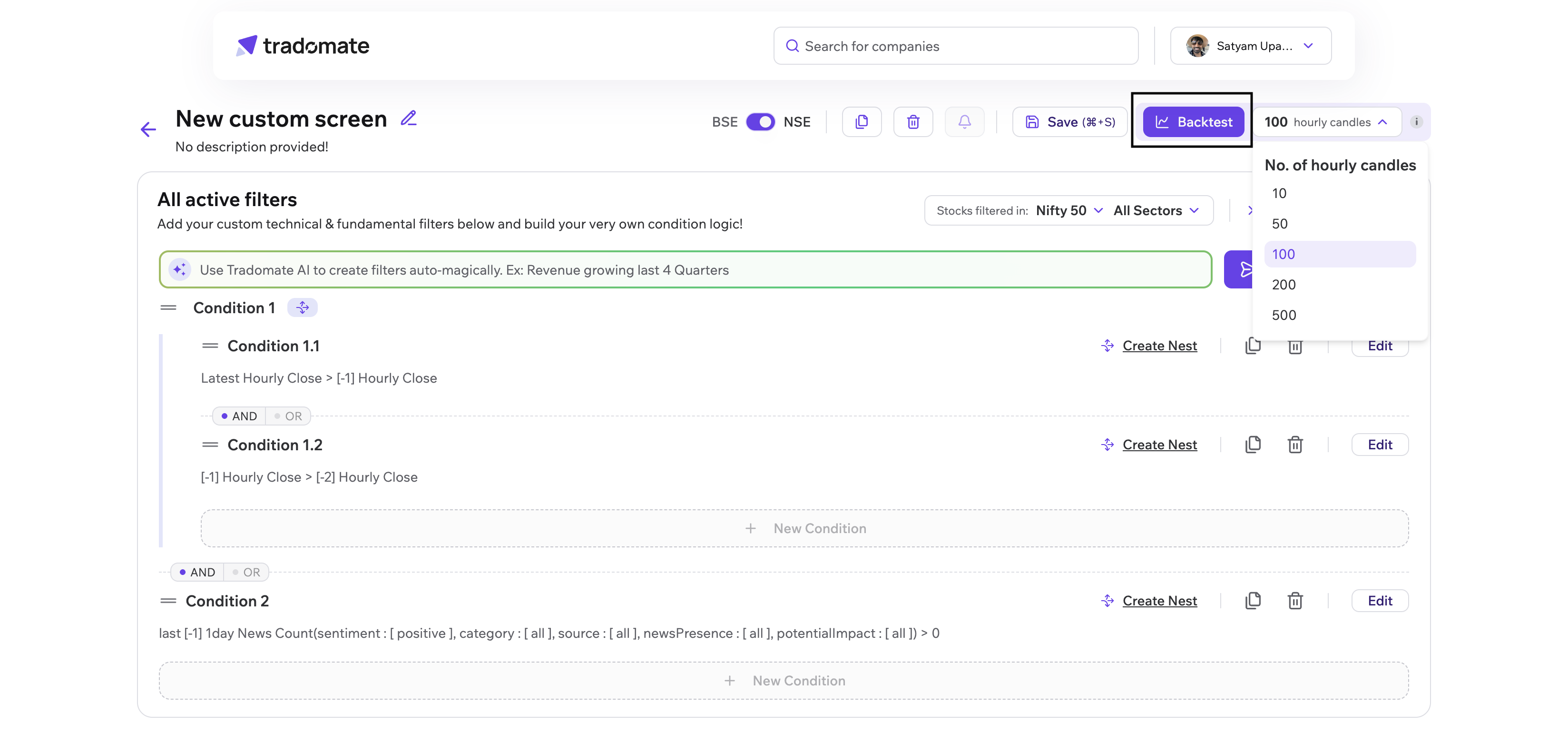

Section titled “Screener Backtesting”Next, configure your backtest settings. You can choose a backtest interval from 10 to 500 candles and then click Backtest.

Let’s do the backtesting for 100 candles.

Understanding the Results

Section titled “Understanding the Results”Once the backtest is complete, Tradomate presents your results in two views - Overview and Deep Dive - helping you understand both the big picture and the finer details of your screen’s performance.

Overview Tab

Section titled “Overview Tab”The Overview section gives you a high-level summary of your backtest. You’ll see the stock and sector with the best win rates, along with the weekday that historically performed strongest. Visual charts help you quickly interpret results:

- Avg. Returns vs Win Rate shows how each stock performed, with higher win rates and stronger returns clustering in the top-right corner: your ideal candidates.

- Distribution of Backtested Returns reveals how consistent your strategy has been, with narrower spreads suggesting steadier results.

The video below explains the importance of both the charts

Deep Dive Tab

Section titled “Deep Dive Tab”The Deep Dive section breaks down performance in detail, letting you analyze results across different stocks, timeframes, and occurrences.

- The Timeline view highlights when your strategy performed best, with a heatmap of average returns and number of occurrences over time.

- The Performance view lists every stock that matches your screen, along with win rates, average returns, and how many times it appeared during the test period.

This granular breakdown helps you identify which stocks consistently benefit from your strategy, and which ones may be adding risk without reward.

The video below explains the importance backtesting deep-dive

With the Screener Backtest, you’re no longer guessing, you’re validating. Start experimenting with different rules, uncover what works best and trade with confidence backed by data.

Make every backtest count and continue to #tradeIntelligently.