Quick Start Rule Based Bot Builder

Powered by Tradomate AI, the Rule-Based Logic Creator makes building and optimizing trading strategies effortless.

Simply define conditions using technical indicators, price action, or custom logic—all in plain English, with no coding required. With advanced features like stop loss, take profit, position handling, and performance attribution, you can seamlessly turn your trading ideas into reality. Easily test and refine your rules to create robust, data-driven strategies.

Walkthrough video

Section titled “Walkthrough video”Setting up your first trading bot with the Rule-Based Creator is simple. Follow the video below to learn how to build and test your strategy using Tradomate’s AI-Powered Rule builder -

Steps to create a AI Powered No Code Bot

Section titled “Steps to create a AI Powered No Code Bot”Setting up your trading bot

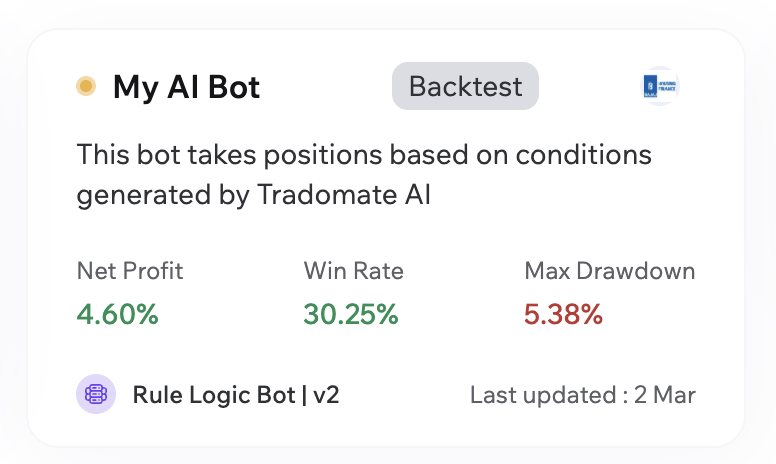

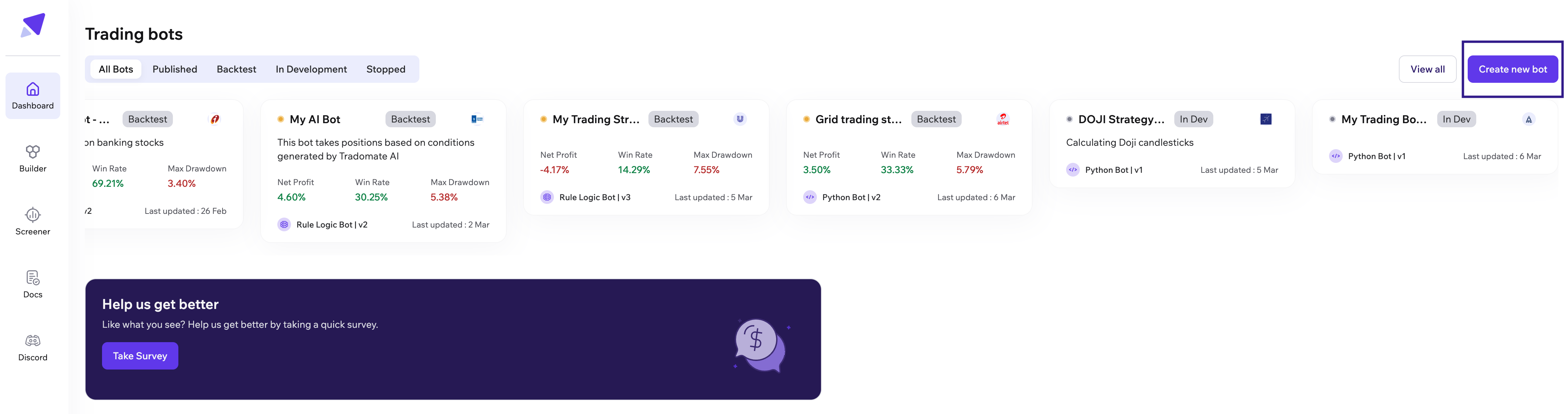

Section titled “Setting up your trading bot”Tradomate.one’s Dashboard gives an overview of how your bots are performing on the selected instrument in the given historical data range

To create a bot, click on create new bot on the dashboard page

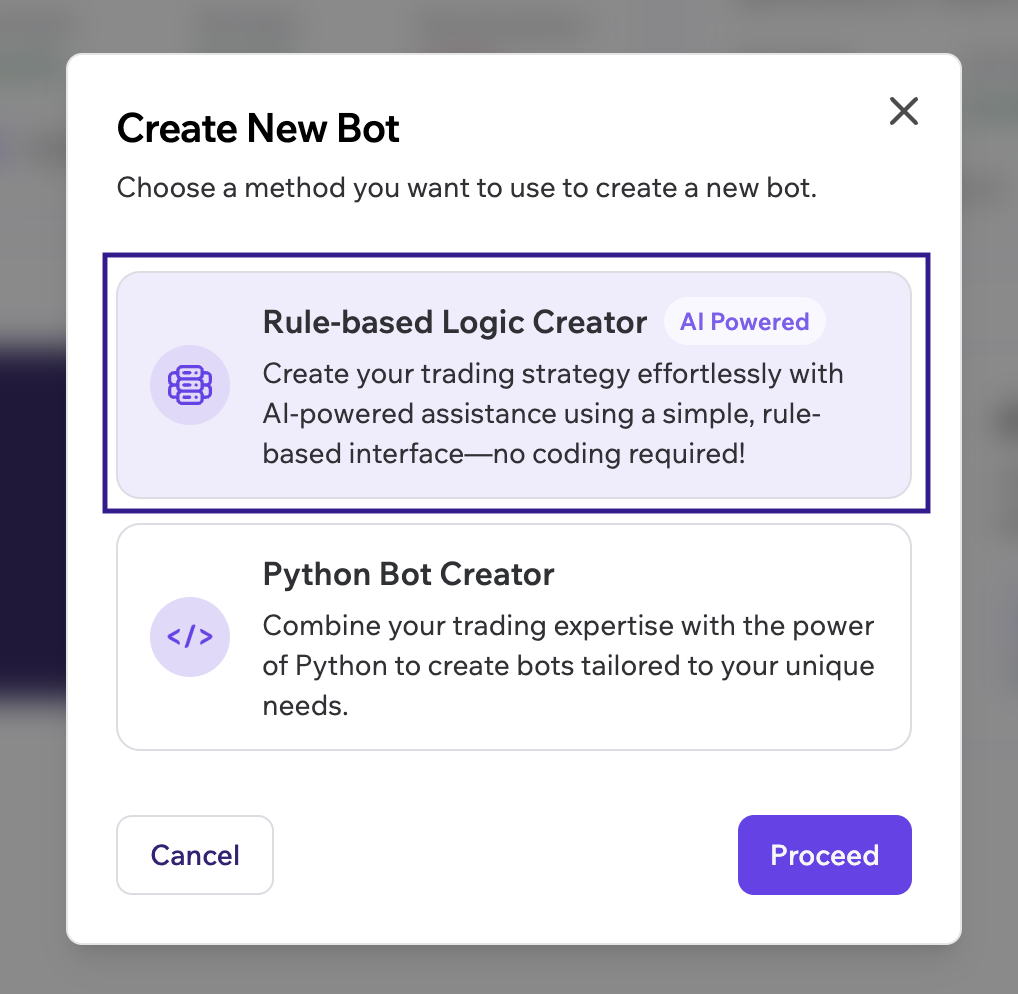

There are two ways in which a bot can be created on Tradomate.one - Python Bot Creator and Rule-based Logic Creator. Select Rule-based bot creator and click on proceed

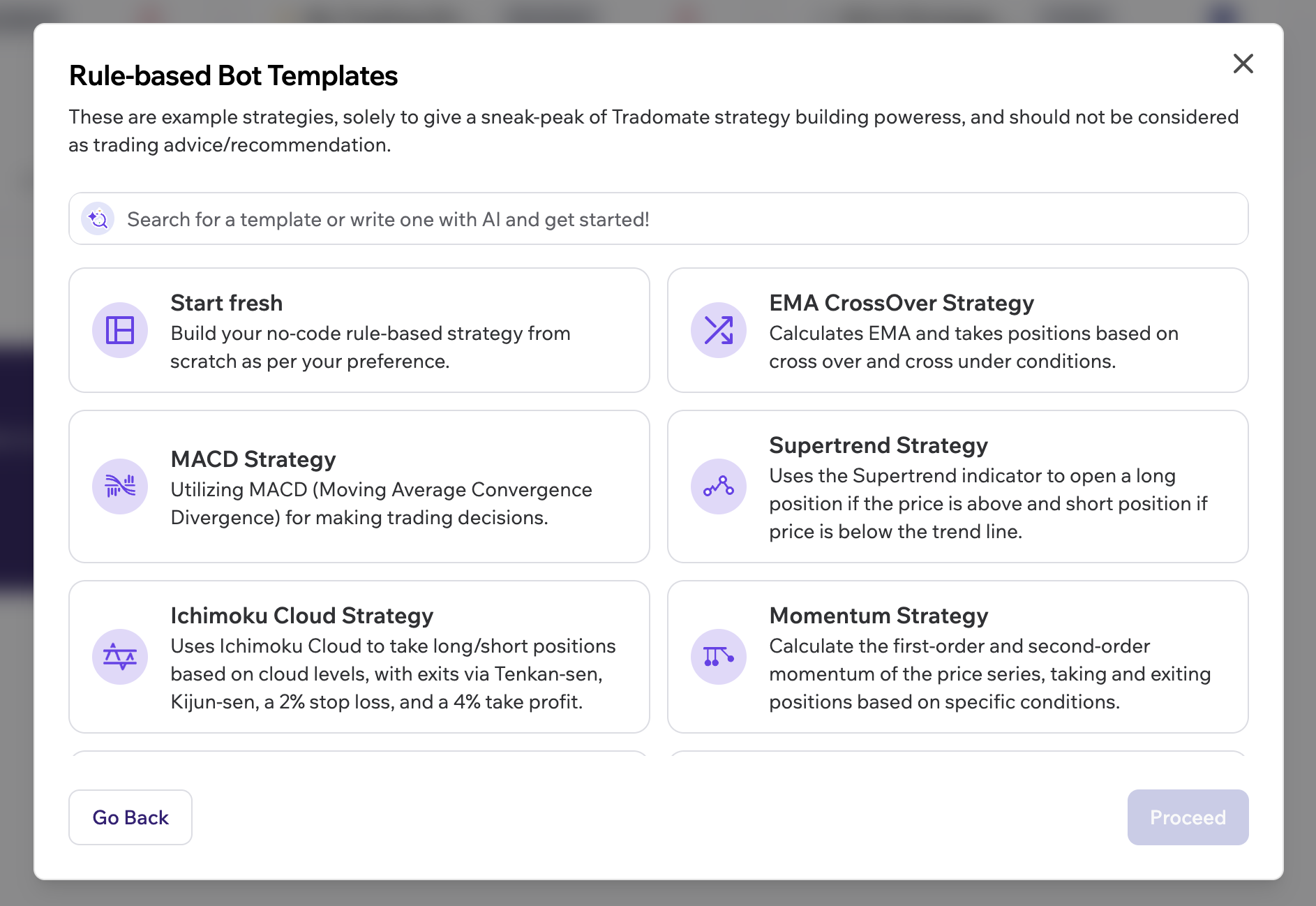

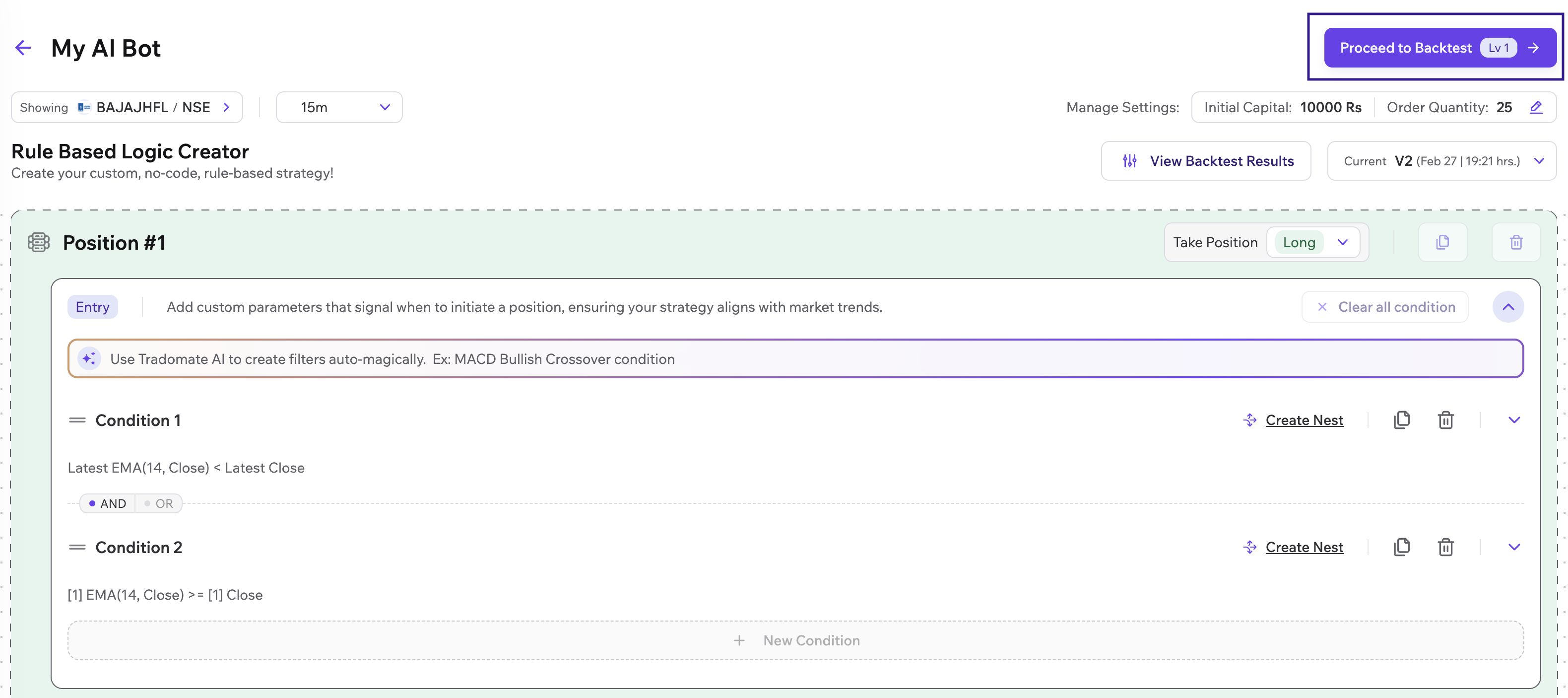

Once proceed is clicked, the creation process begins. There are three ways in which a strategy can be created -

- Choose any of the predefined templates provided to get started.

- Start with a Blank Template and add your conditions manually/or through Tradomate condition builder

- Use Tradomate AI to get started.

Tradomate.one’s bot builder page works like a cockpit for strategy formulation. Various components of the builder page include -

- The candlestick chart for the selected instrument

- Section to update bot details like the name and description along with setting inputs for Short Margins, Commissions, and Pyramiding Orders

Once the strategy is created, proceed to backtest the strategy and observe the results. Click on Proceed to Backtest button on the top right to start backtesting!

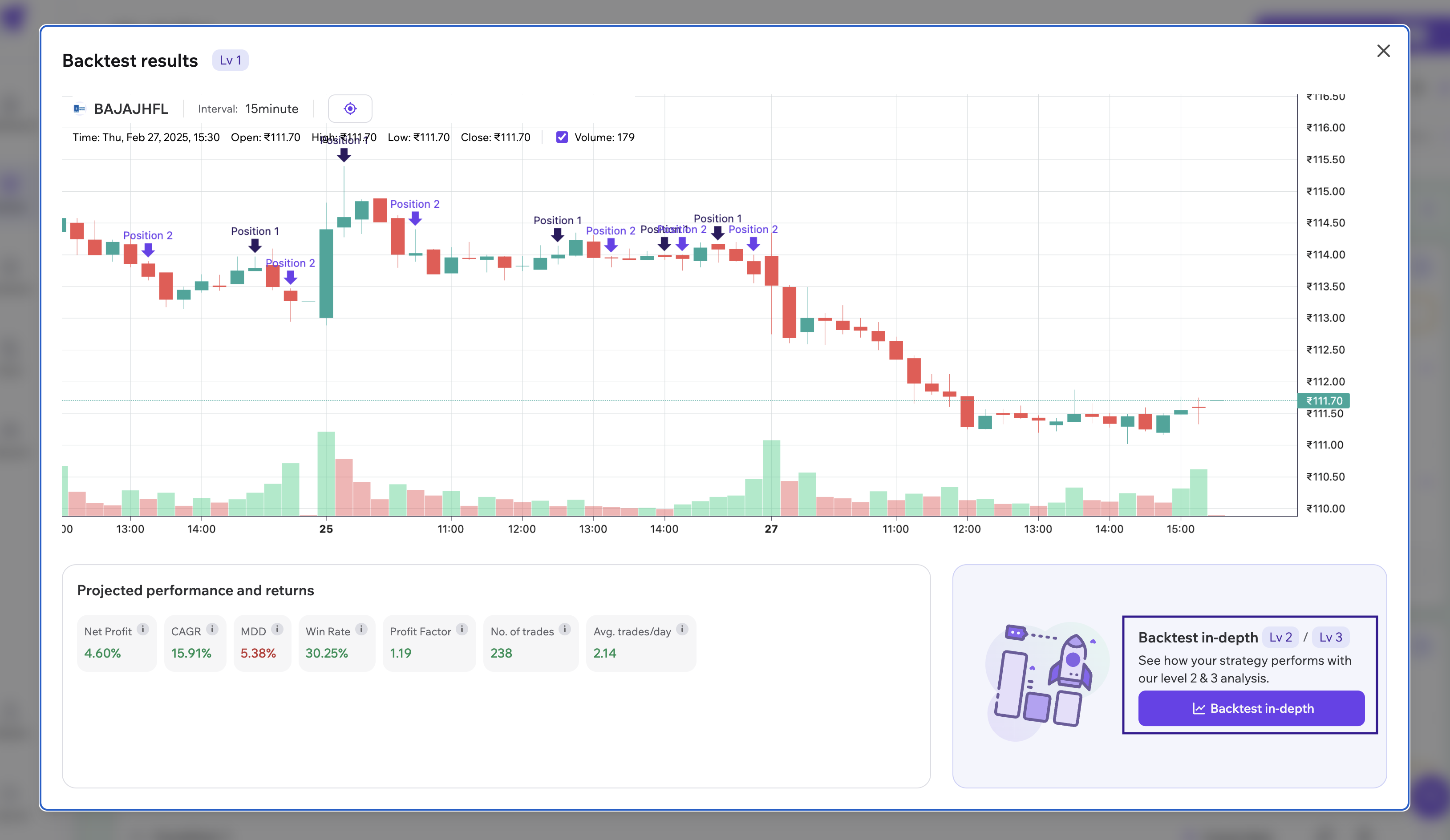

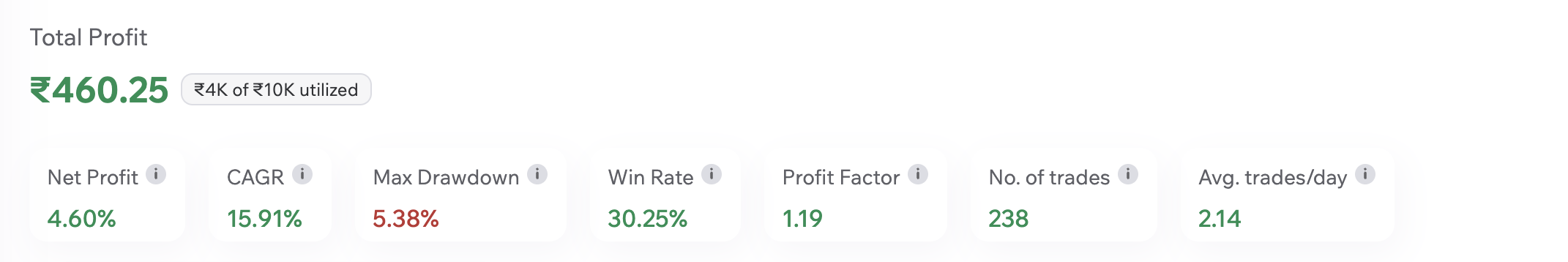

We have divided the backtesting results in three layers along with the Equity Curve and the candlestick chart showing all the orders placed. The Layer 1 backtesting metrics can be seen on the strategy page itself.

Users can deep-dive into a more detailed analysis using our other two in-depth Backtesting layers! Click on in-depth backtesting and proceed to look at the detailed backtesting analysis Tradomate.one has to offer!

Performance and Order Screen

Section titled “Performance and Order Screen”Tradomate.one’s detailed backtesting page offers a unique view to analyze strategy across multiple KPIs clubbed under three layers -

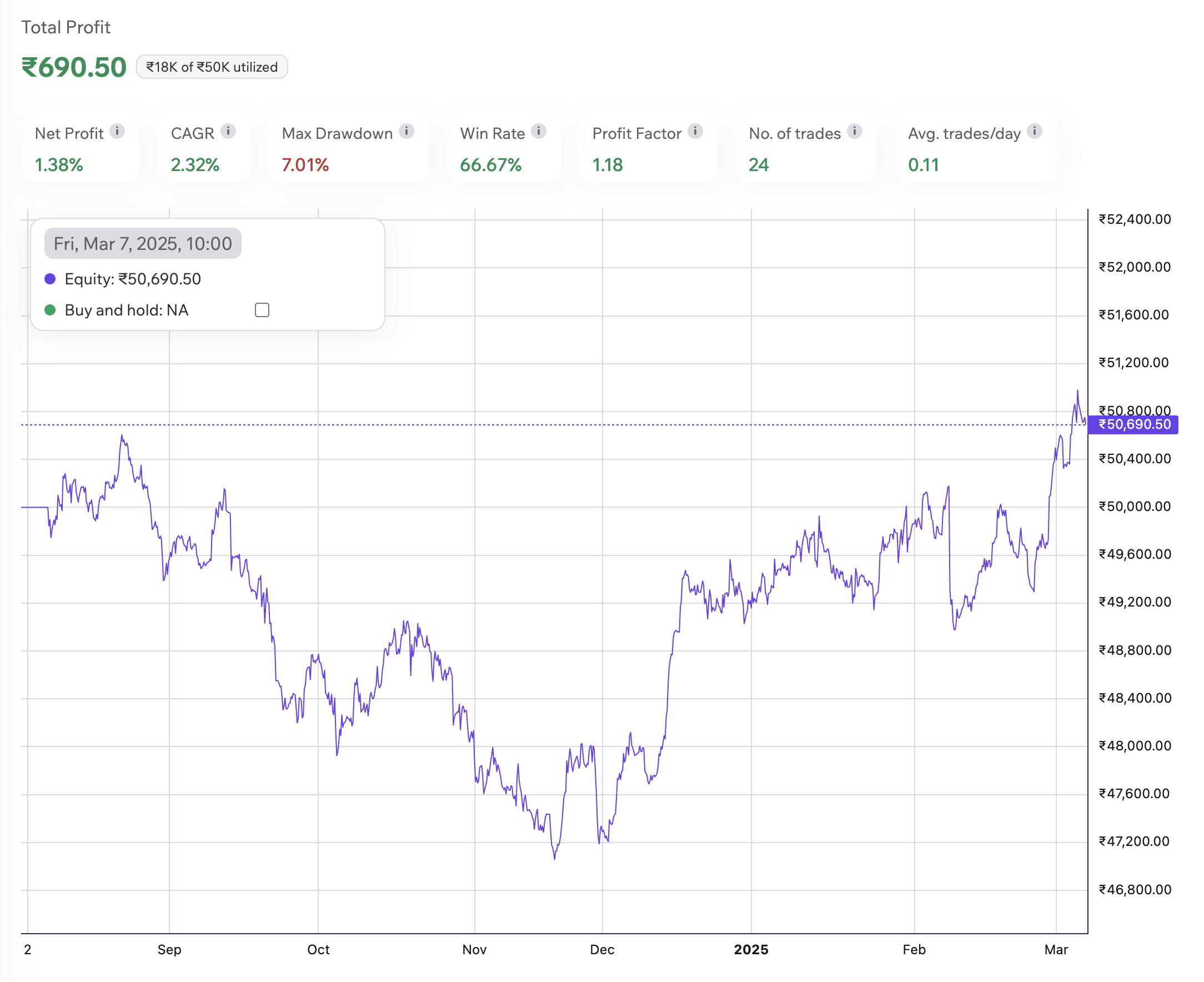

Performance and returns analysis

Section titled “Performance and returns analysis”Layer 1 focuses on performance and returns KPIs like profitability, draw-down, CAGR, etc

Risk and Ration analysis

Section titled “Risk and Ration analysis”Layer 2 focuses on risk-adjusted returns like Sharpe ratio, calmer ratio, beta, buy and hold returns, etc

Scenerio and senstivity analysis

Section titled “Scenerio and senstivity analysis”Layer 3, exclusive to Tradomate, focuses on

- Simulating market conditions and understanding strategy performance for various trend scenarios (If the market is bullish/bearish/sideways), event scenarios (Pre-post elections, international conflicts like Isreal-Hamas, Ukraine-Russia, Covid), or any specific time-based scenarios (Current offering)

- Identifying and understanding the influence and impact of individual parameters used in the strategy on Layer 1 and Layer 2 KPIs (Coming Soon)

- Input optimization and Behavioural analysis on the strategy/market conditions (Coming Soon)

The Equity curve allows users to check how the strategy has been performing and let users benchmark against the Buy & Hold curve.

The order screen of Tradomate.one tracks the orders placed and the positions opened/closed by the strategy

After this brief introduction, you can now create your own trading bots. To fully utilize all features offered by Tradomate.one, it is highly recommended to continue studying this documentation to #tradeIntelligently.