Quick Start Backtecting

Setting up your first trading bot with Python is straightforward, thanks to built-in functions and popular libraries that simplify the process. With advanced features like order types, position handling, and performance attribution, you can seamlessly transform your trading ideas into reality.

Let’s take a look at the process to setup your first bot -

Setting up your trading bot

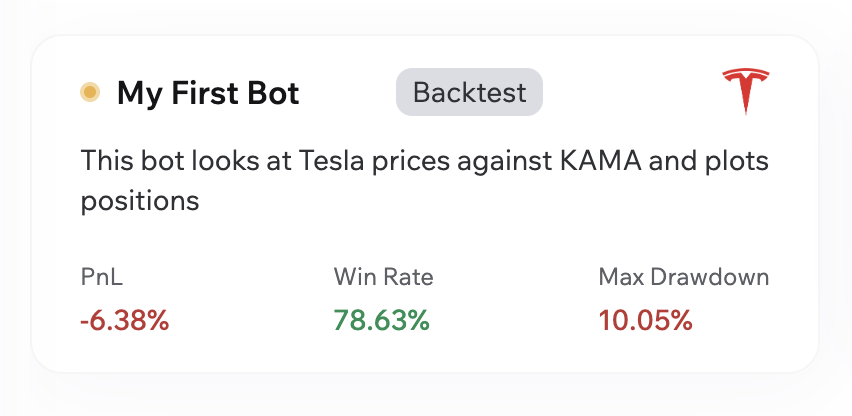

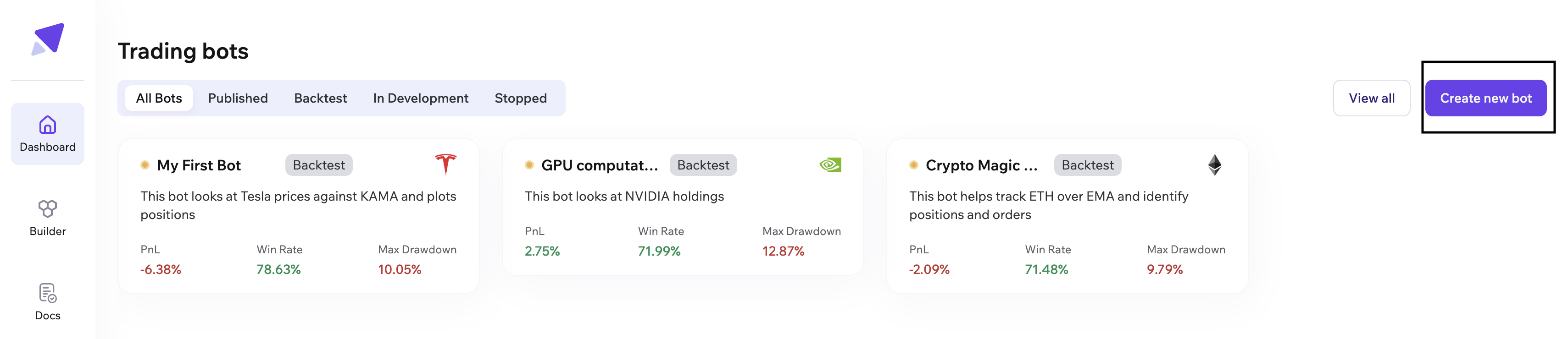

Tradomate.one’s Dashboard gives an overview of how your bots are performing on the selected instrument in the given historical data range

To create a bot, click on create new bot on the dashboard page

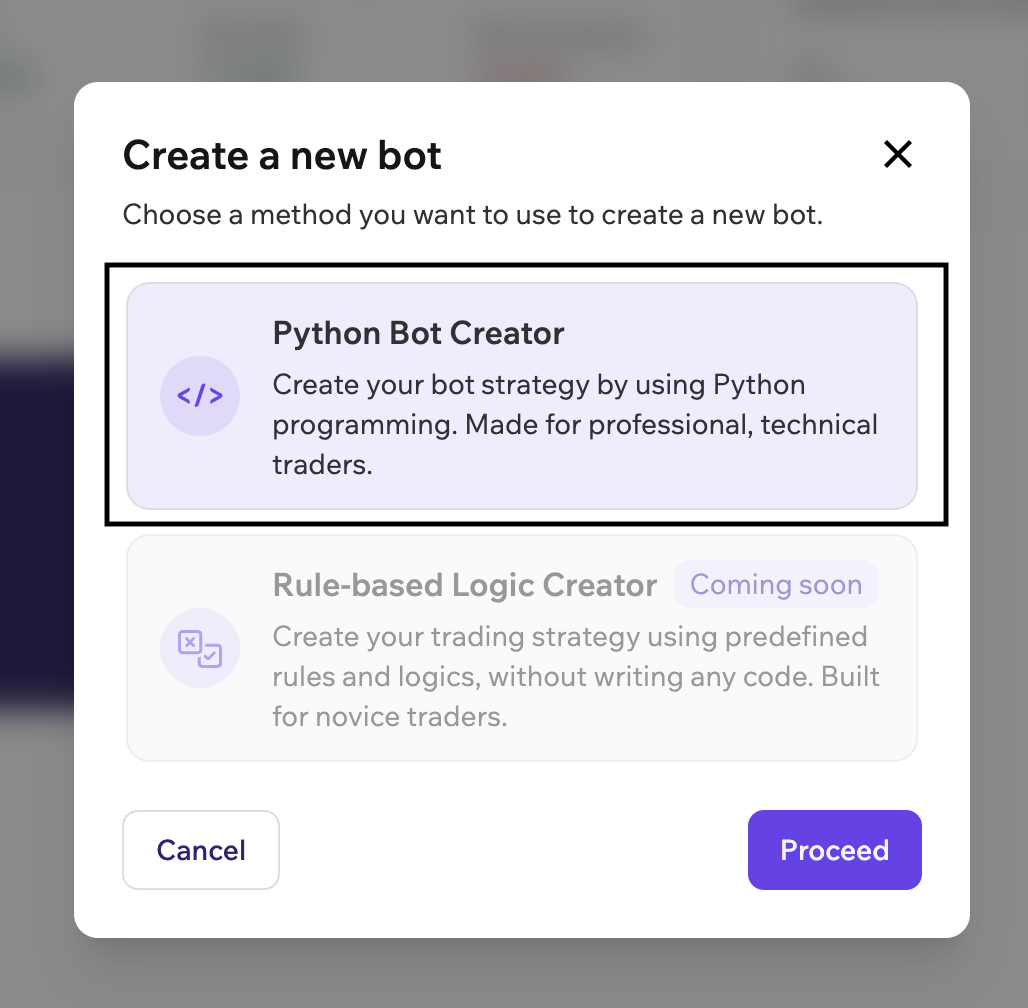

There are two ways in which a bot can be created on Tradomate.one - Python Bot Creator and Rule-based Logic Creator. For now, we have the Python Bot Creator enabled to create a bot. Select that and click on proceed

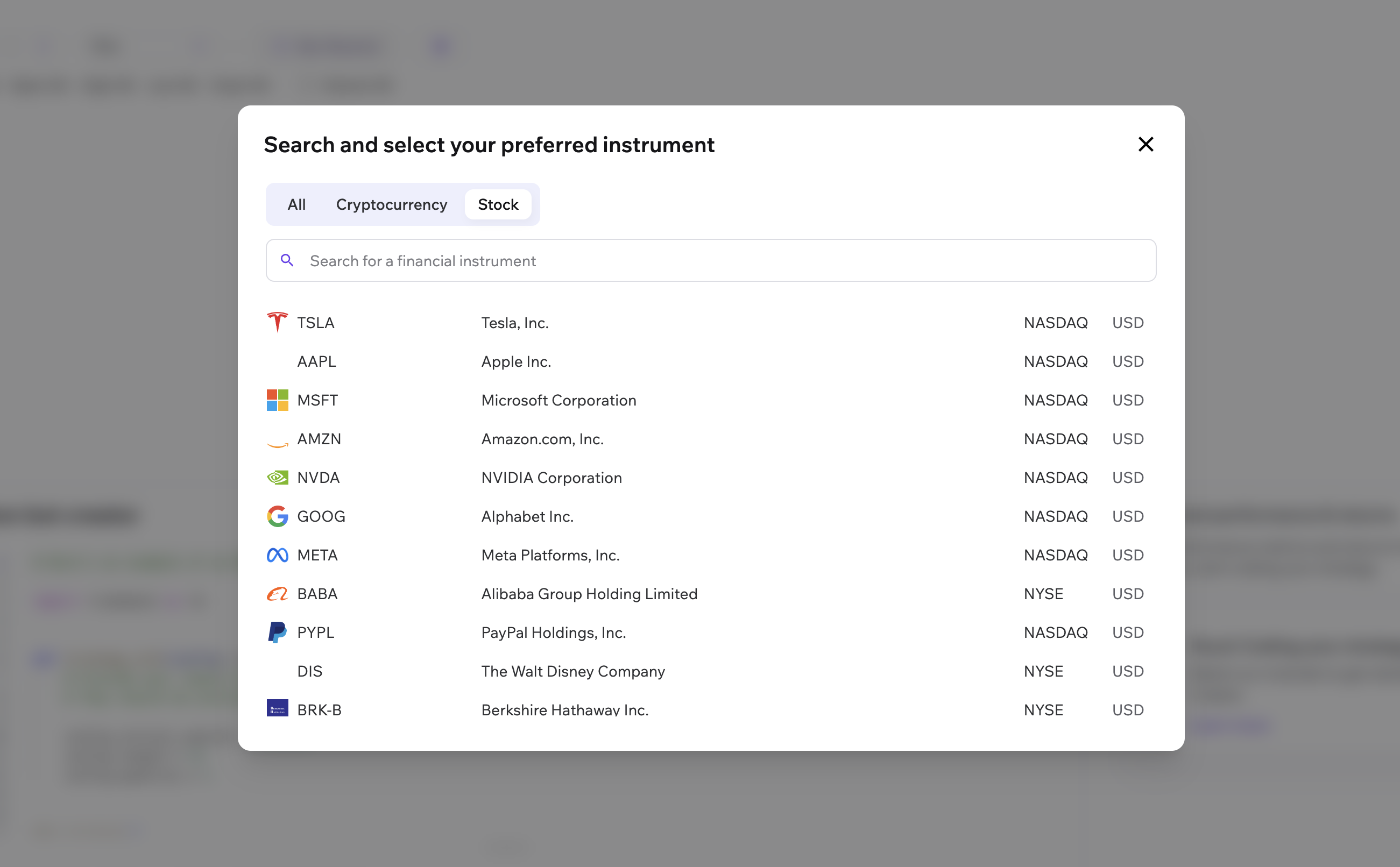

Once proceed is clicked, the creation process begins, prompting the user to search and select their preferred instrument. For now we are connected

with exchanges in USA and India and you can backtest the following asset classes through our interface - US stocks, Indian stocks, Crypto.

Select the preferred instrument that you wish to use for building the strategy on and voila! The bot is created!

Sample trading bot with a simple strategy

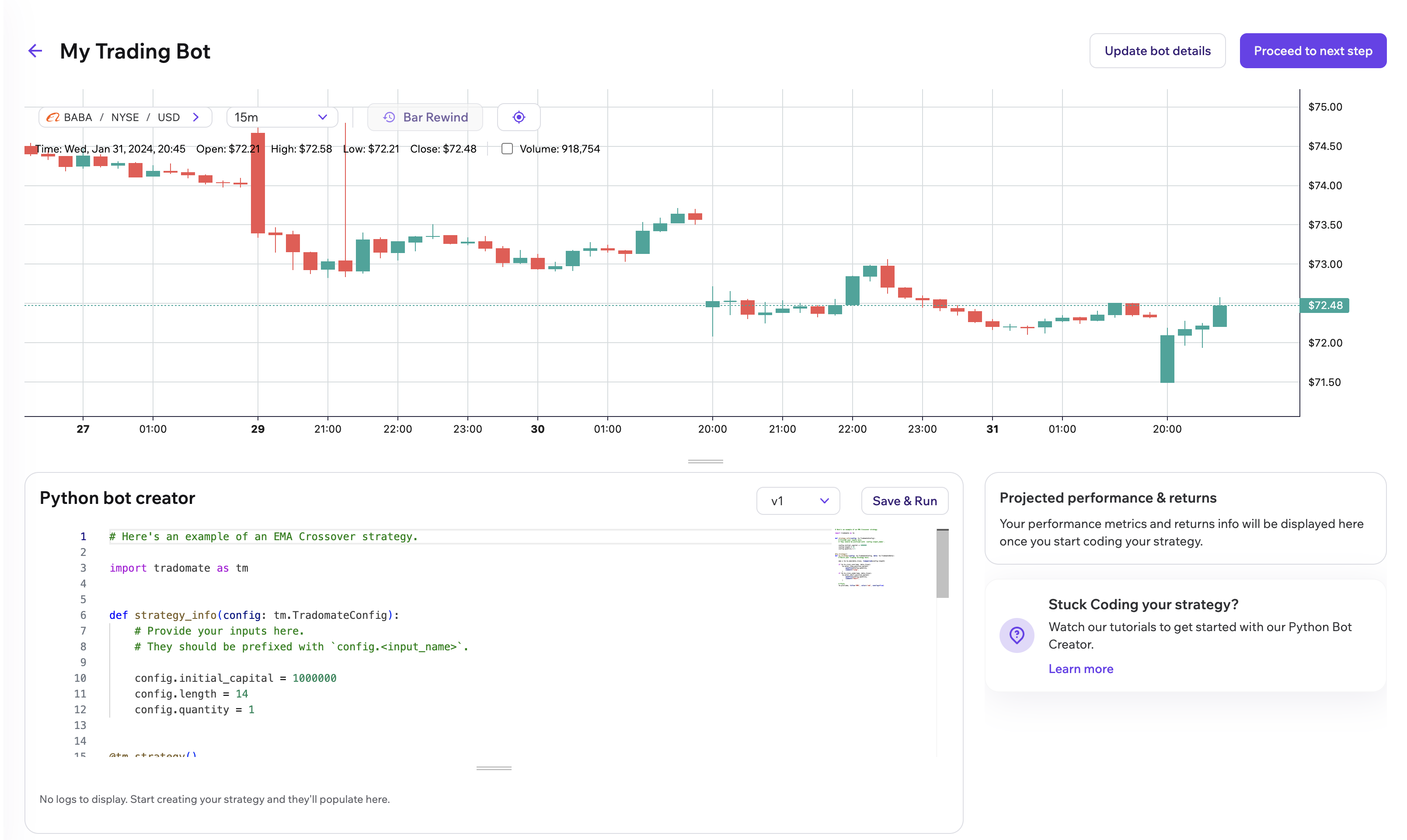

Tradomate.one’s bot builder page works like a cockpit for strategy formulation. Various components of the builder page include -

- The candlestick chart for the selected instrument

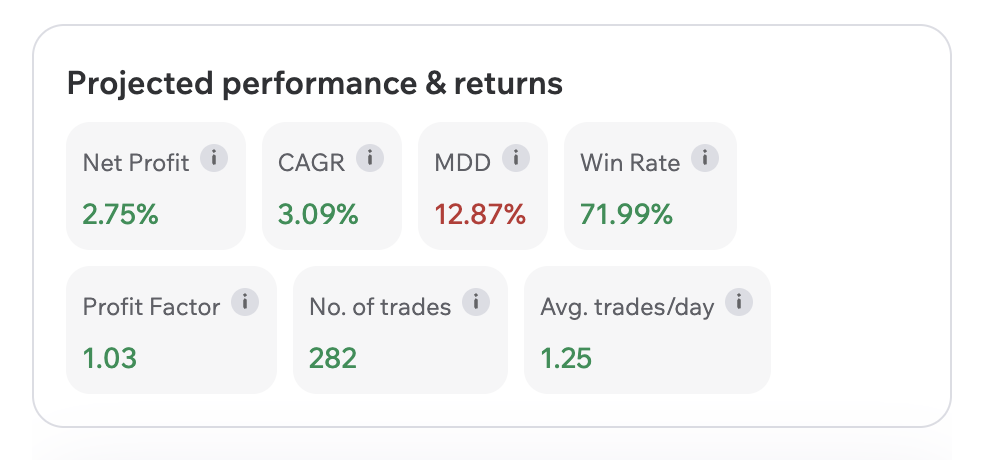

- Python bot editor for creating the strategy

- Section to update bot details like the name and description along with setting inputs for Short Margins, Commissions, and Pyramiding Orders

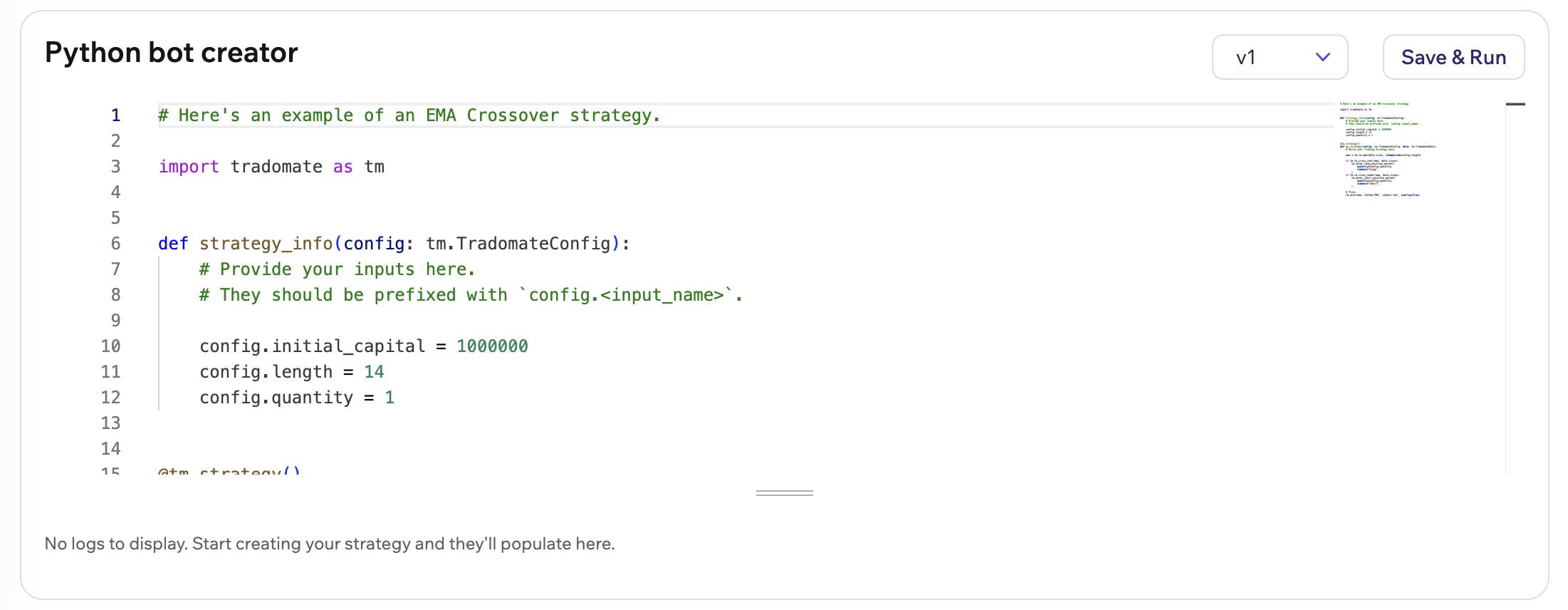

- Section to understand the performance and returns of the trading strategy (Level1 Backtesting results)

To enhance bot creation and facilitate user familiarity with the Python bot creator, Tradomate.one offers a pre-loaded sample strategy in the editor. Users can quickly start by either editing it to match their needs or running it directly to experience its full functionality!

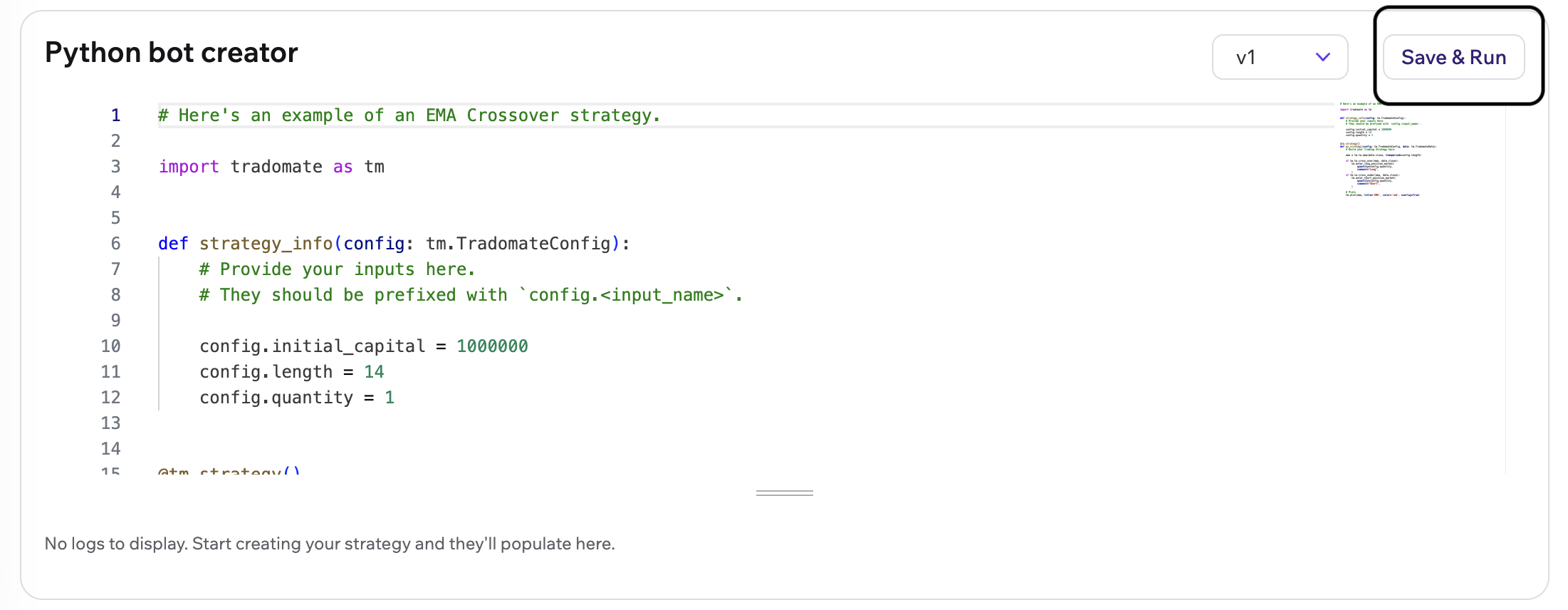

Once the strategy is created, all is needed is to save and run the strategy to backtest and observe the results. Click on save and run button on the python code editor screen to start backtesting!

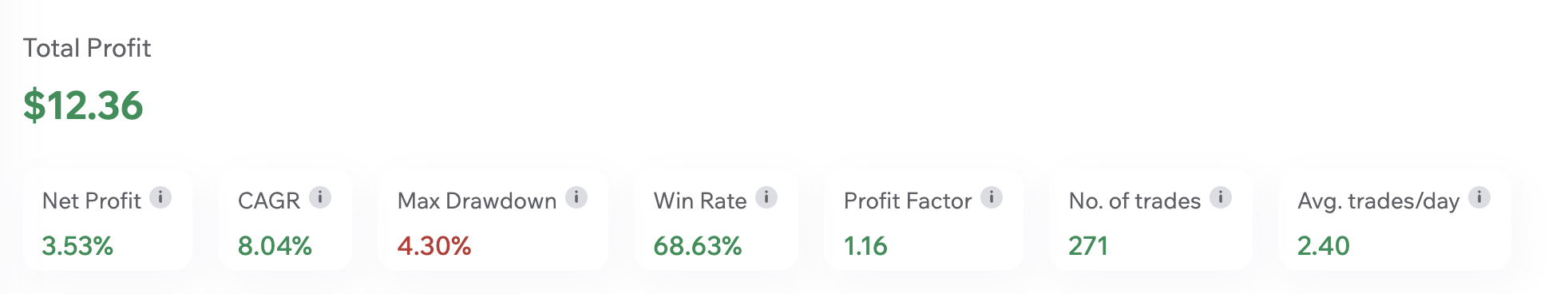

3 Layered Backtesting Approach: We have divided the backtesting results in three layers along with the Equity Curve and the candlestick chart showing all the orders placed. The Layer 1 backtesting metrics can be seen on the strategy page itself while users can deep-dive into a more detailed analysis using our other two in-depth Backtesting layers!

Once you are done tweaking your strategy, click on proceed to next step button on the top right, choose in-depth backtesting and proceed to look at the detailed backtesting analysis Tradomate.one has to offer!

Performance and Order Screen

Tradomate.one’s detailed backtesting page offers a unique view to analyze strategy across multiple KPIs clubbed under three layers -

- Performance and returns analysis

- Risk and Ration analysis

- Scenerio and senstivity analysis (Coming soon!)

The Equity curve allows users to check how the strategy has been performing and let users benchmark against the Buy & Hold curve.

The order screen of Tradomate.one tracks the orders placed and the positions opened/closed by the strategy

After this brief introduction, you can now create your own basic trading bots. To fully utilize all features offered by Tradomate.one, it is highly recommended to continue studying this documentation.