Beyond the Screen: Hands-On Screener Backtesting with Tradomate.one

Tradomate.one is rethinking the analysis-backed trading experience, turning screeners into something accessible, actionable, and directly tied to real trading decisions.

Over the last two posts, we’ve laid the foundation for why screener backtesting matters and the challenges that come with it. In Part 1, we explored why screens shouldn’t stop at simply filtering stocks - the real value lies in testing how those filters would have actually performed in the market. In Part 2, we dug into the common pitfalls of backtesting - accuracy issues, the lack of universal exit strategies, the difficulty of accounting for news events and the problem of information overload.

All of this points to a clear gap: while screener backtesting is powerful in theory, very few platforms actually make it practical. That’s where Tradomate.one comes in. In the third part of this series, we’ll walk through how Tradomate is rethinking the analysis backed trading experience - turning what has traditionally been a tedious, error-prone process into something accessible, actionable, and directly tied to real trading decisions.

This discussion is split into two core sections: first, Ideation & Spotting Opportunities, where we look at how screeners can surface potential trades; and second, the Research and Historical Trends, where we address some of the pitfalls highlighted in Part 2 of this blog series.

Spotting opportunities isn’t just about applying filters - it’s about moving from ideas to structured screeners with little manual effort, along with the ability to customize and build across traditional and new-age signals. Tradomate bridges this gap by combining technicals, price actions, fundamentals, and news, making it far easier for traders to experiment, refine, and uncover signals that align with their style.

Here’s how the ideation layer comes alive on Tradomate:

One of the biggest hurdles in trading is moving from an idea in your head to a structured screener/ruleset that can represent your idea. Traditionally, this requires writing complex queries, combining multiple filters, and having a strong grasp of both data and technical language.

With our Generative AI based query feature, this process is as simple as typing - “Nifty 500 stocks in news and having DII holding at an all-time high”.

Tradomate screener translates natural language into a screener that blends price actions, technical indicators, fundamentals, and even news filters. By lowering the barrier between idea and execution, traders can experiment more freely and iterate faster.

Tradomate is the only platform that lets you filter stocks based on news dimensions, giving traders a powerful edge in spotting opportunities before the market reacts.

You can screen stocks by:

Example: Stocks with high impact news in the last 4 hours

With these granular filters, Tradomate makes it easy to spot news-driven opportunities that other platforms often miss. You can also incorporate these filters into your backtests, ensuring that results aren’t distorted by historical news events - unless your strategy explicitly relies on them.

(Note: historical news data is available from March 2025.)

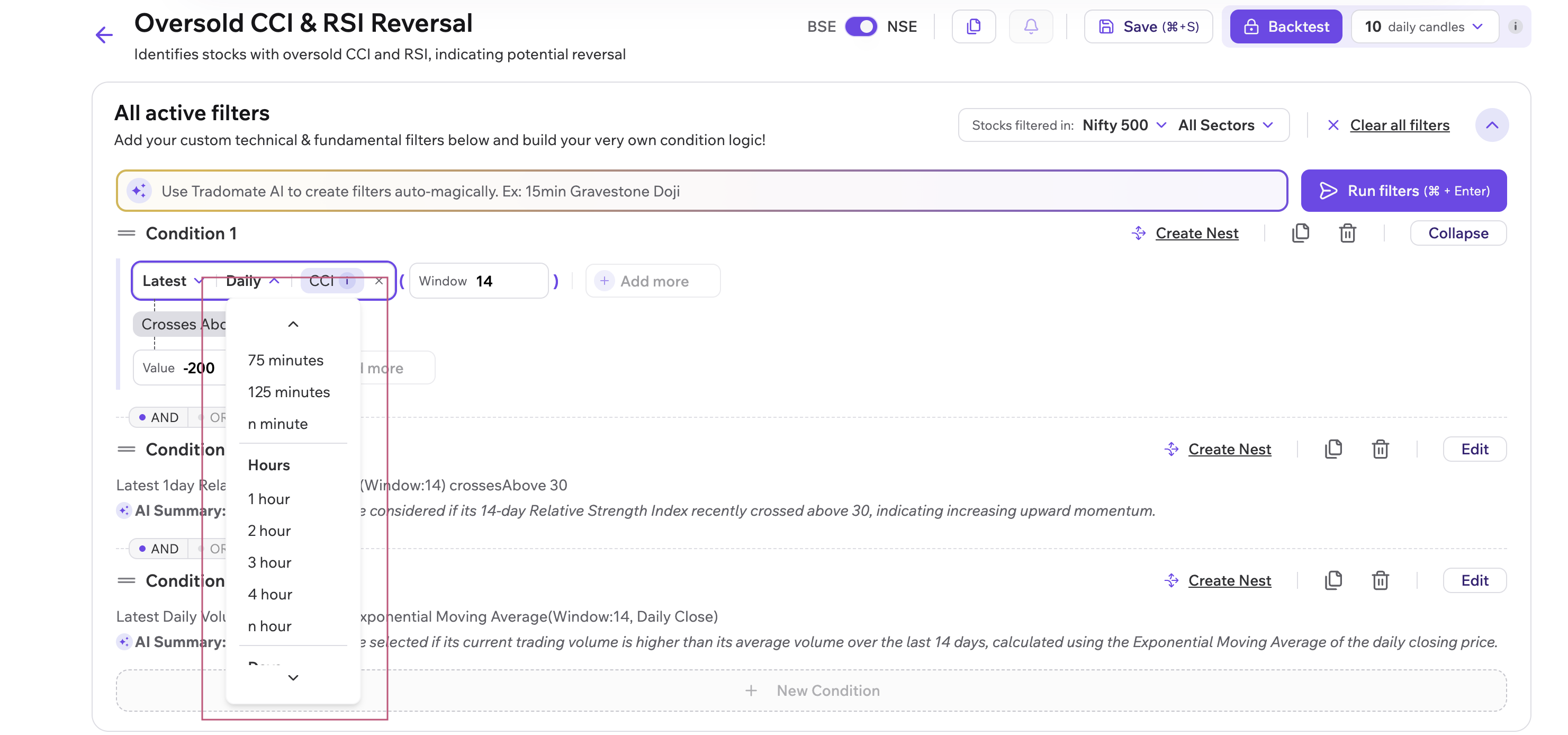

Want a 7-minute candle or a 71-minute candle? We’ve got you covered. Tradomate lets you create custom intraday candles beyond the standard 1m, 5m, 15m, 1h intervals. Whether you prefer unconventional periods like 7 minutes or 71 minutes, or want to define your own n-minute / n-hour timeframe - you have complete flexibility.

This means your strategies are no longer limited to candle intervals supported by traditional charting platforms. You can fine-tune signals and backtests with exactly the timeframe that fits your trading style. Needless to say, you dont have to worry about peeking problems either - we have got you covered.

Even the best screeners and backtests only take you half-way - real trading decisions happen day by day, shaped by both stock-specific signals and broader market context. To support this, Tradomate offers a Daily Trade Setup Companion that brings these two powerful layers together.

Stock-Specific Insights

Each day, Tradomate AI surfaces actionable insights based on real-time technical, price action, and volume patterns. Instead of sifting through thousands of charts, traders can directly see setups like support bounces, MACD triggers, or breakout signals - with historical context on how these setups have played out before.

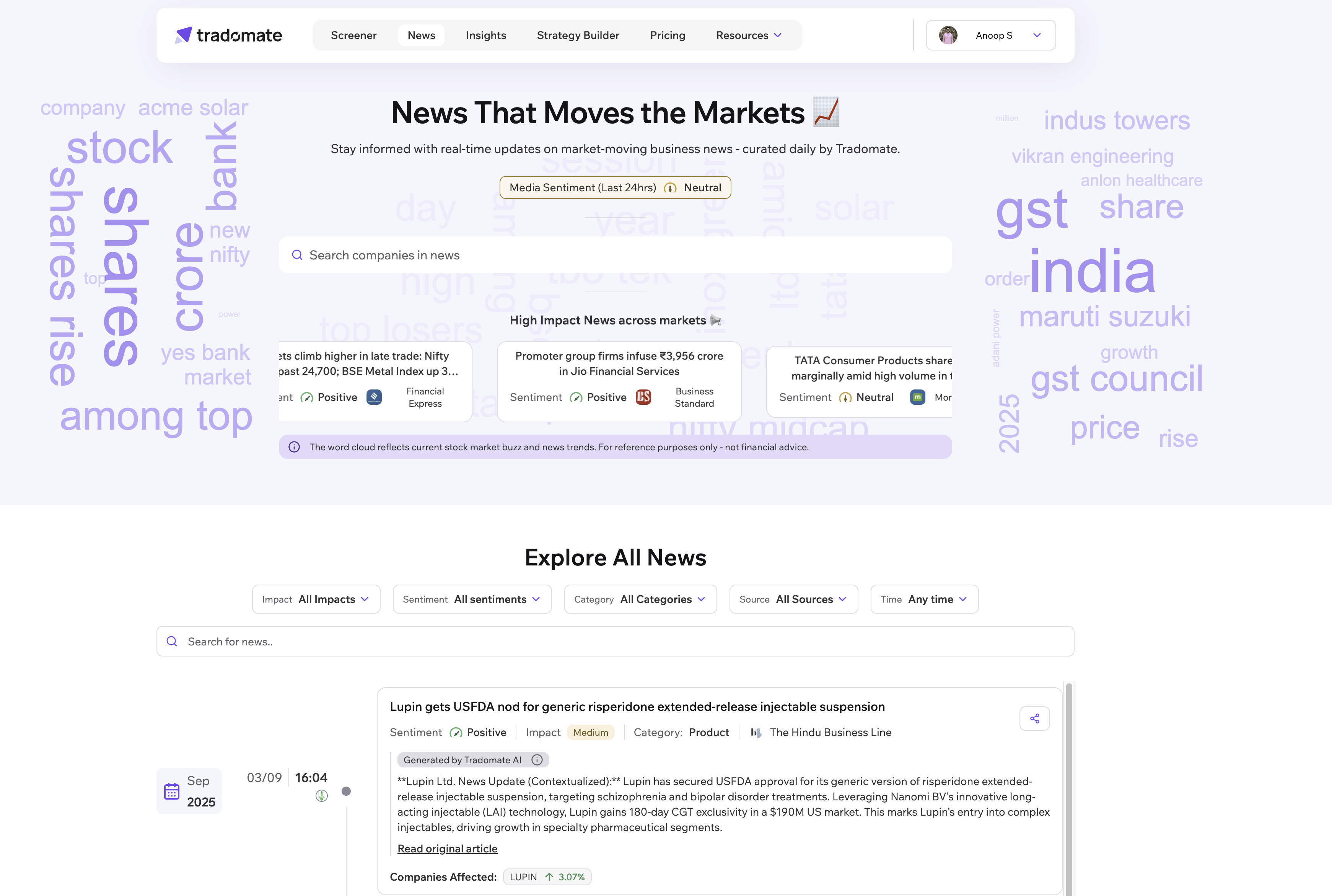

News & Media Sentiment

Markets don’t move on charts alone. With integrated news feeds and sentiment analysis, Tradomate highlights the stories most likely to move specific stocks. Positive or negative news is automatically categorized by impact, sector, and relevance, helping traders quickly assess whether a signal is supported (or contradicted) by market-moving events.

The word-cloud highlights recurring themes or phrases from financial news/exchange filings, making it easy to spot what the market is focusing on for a stock or sector or theme. For example, if “merger,” “SEBI,” or “earnings miss” keeps showing up, you instantly know the narrative driving price moves.

By combining technical insights with news sentiment, traders can build holistic daily watchlists that align setups with real-world catalysts.

Once you’ve designed a screener, the real question is: has this idea actually worked in the past? Tradomate’s Screener backtesting module bridges the gap between theory and evidence, letting traders validate their strategies with rich historical context. Backtesting on Tradomate goes beyond a simple “pass/fail” result - it gives traders a rich picture of how a screener would have performed across time, stocks, and market conditions.

In Part 2 of this blog, we highlighted some of the common pitfalls that make backtesting unreliable - things like not knowing what average returns to expect, peeking into larger candle sizes, or testing strategies in a “vacuum” without accounting for news. On Tradomate, these challenges don’t just get patched over - they’re designed out of the process.

By addressing these pitfalls head-on, Tradomate makes historical backtesting not just more accurate, but more actionable - a direct input into how traders refine and execute their strategies

Here’s a peek at what’s cooking next at Tradomate -

Smarter Exit Conditions

Getting into a trade is only half the game, knowing when (and how) to get out is just as important. We’re working on features that suggest exit conditions like stop-loss, take-profit, and holding periods. These won’t be random numbers either, they’ll be backed by data like return distributions, drawdowns, and past performance patterns. Basically, a guide to help you manage trades with more confidence.

Alerts and Notifications - Insights That Come to You We don’t think you should be chasing insights, they should find you based on your trading philosophy. Soon, Tradomate will be able to push updates straight to you based on your screeners and watchlists. If there’s something worth your attention, you’ll know about it without digging around.

We’re excited about the potential of analysis-driven trading and would love to hear your thoughts as we shape what’s ahead. Give Tradomate a spin here: https://tradomate.one/screener

Other blog articles

Start your seamless trading journey now and experience the power of our comprehensive trading solutions.