Backtesting is a powerful way to validate trading ideas and bring structure to decision-making. Done well, it helps traders see how a setup might have performed historically and sets expectations around potential returns, drawdowns, and holding periods. In the first post of this series - we explored why stock screens need to go beyond simple filtering, this follow-up takes the next step. Because, like any analytical tool, the real value of backtesting depends entirely on how well it’s executed.

In many cases, retail traders rely on backtests built into generic screener platforms or run their own DIY versions in spreadsheets. While useful, these approaches often come with blind spots - such as limited data coverage, simplified assumptions, or overlooked variables like transaction costs or news-driven volatility. Left unchecked, these gaps can lead to an inflated sense of confidence in a strategy.

In this second part of the series, we’ll unpack some of the most common pitfalls in backtesting. The aim is not to discourage its use - quite the opposite. By being aware of where and how backtests can mislead, traders can make better use of the tool and build strategies that are both realistic and robust.

Part 2: When Screener Backtests Mislead - Pitfalls Every Trader Should Know

At its core, a screener backtest is simply asking: if this screener had flagged stocks in the past, what would have happened if I traded them?

For a trader, the value lies in translating a list of filtered stocks into a set of measurable outcomes. You want to see which stocks consistently came up, how often they appeared over months or years, and whether their price movements aligned with your trading philosophy.

You also want clarity on how long you’d likely be holding positions, what kind of drawdowns to expect, and where realistic take-profit and stop-loss levels might sit. In essence, a screener backtest gives you a preview of the strategy hidden inside your filters - helping you gauge not just what stocks to pick, but how those picks typically behave once you act on them.

Let’s now deep dive into the pitfalls of backtesting with existing tools in the market and some considerations while backtesting screeners -

Backtesting Accuracy: Peeking with Higher Candle Sizes

When a screener mixes different timeframes - like using a 1-hour candle alongside a 1-day candle, backtests can quietly “peek” at information that wasn’t actually available in real time. For example, a trade taken mid-day might get backtested using the completed daily candle, which only exists after market close; this is a classic case of peeking before the event has occurred. Example below shows how a popular platform calls this out as a disclaimer instead of solving for the problem -

Example

Imagine your screener is looking for cases where the 1-hour EMA crosses above the 1-day EMA, signaling a possible price rise. The mistake many backtests make is to calculate the 1-day EMA using the day’s final closing price - but that data is only available after market close. If you’re testing at 10:15 AM, you can’t “know” where the day will close.

A correct backtest would instead compute the 1-day EMA progressively, using the data available at each point in time - 9:15, 10:15, 11:15, and so on. That way, the higher-timeframe indicator reflects what a trader could realistically see during the day, not hindsight from the completed daily candle.

Entries and exits should always be evaluated on the smallest candle you’re screening signals on (your execution timeframe). Higher-timeframe signals (daily, weekly) should be considered as they stood at that moment, not after the bar has closed.

Confounding Events: Trading in a Vacuum

Backtests often look deceptively clean because they treat all setups as if markets exist in isolation. But in reality, stock prices are constantly swayed by news and corporate events - earnings announcements, management changes, regulatory actions, or sudden global shocks. The problem is that news is extremely hard to quantify in a backtest. Unlike price or volume data, which is structured and easy to replay, news is messy and unstructured.

To accurately filter for news-driven moves, you would need to compile a historical record of every significant event for every stock - not just the headlines, but the exact timestamps, the type of event, and whether it coincided with the screener flagging that stock. That’s a tedious and resource-heavy exercise, which is why no platform attempts to solve for it. Instead, backtests typically assume a “news-neutral” environment, ignoring whether a move was triggered by fundamentals, sentiment, or one-off announcements.

The risk here is obvious: a stock may look like it consistently outperforms under your screener, when in fact the bulk of those moves were driven by unpredictable events (like news, earnings surprises, geopolitical events, and so on). Unless your strategy explicitly trades such volatility, those results can give a false sense of edge.

However, this begs the question - can a trader ever truly account for all news events? Obviously not - Better some than none right? right?

Exit conditions: One-Size-Fits-All Exits

A common blind spot in screener backtests is the assumption that every stock should follow the same exit strategy. Traders often default to rigid rules like “exit after 5 days” or apply uniform take-profit and stop-loss levels across the board. While this keeps the backtest simple, it ignores the reality that each stock has its own rhythm of price movement.

The right way to approach exits is to let the backtest itself uncover them. By studying how a screener’s signals have historically played out, traders can see the natural holding period during which most of the expected price movement occurs. For one stock, the move may reliably unfold within 3-4 sessions; for another, it may take two weeks. Instead of forcing an arbitrary timeline, the data should guide the duration.

The same principle applies to take-profits and stop-losses. These levels aren’t universal - they depend heavily on the stock’s volatility and trading behavior. A high-beta stock might demand wider stop-loss levels and more generous targets, while a steadier stock might reward tighter exits. Historical backtests can surface these ranges: showing, for example, that trades typically draw down by 4-5% before turning profitable, or that the average winning move stalls after a 12% gain.

When exits are tailored to a stock - it shifts the question from ‘How long should I hold?’ to ‘How long does this stock, under these screener conditions, usually take to move?’ That subtle change turns generic exits into strategy-specific insights.

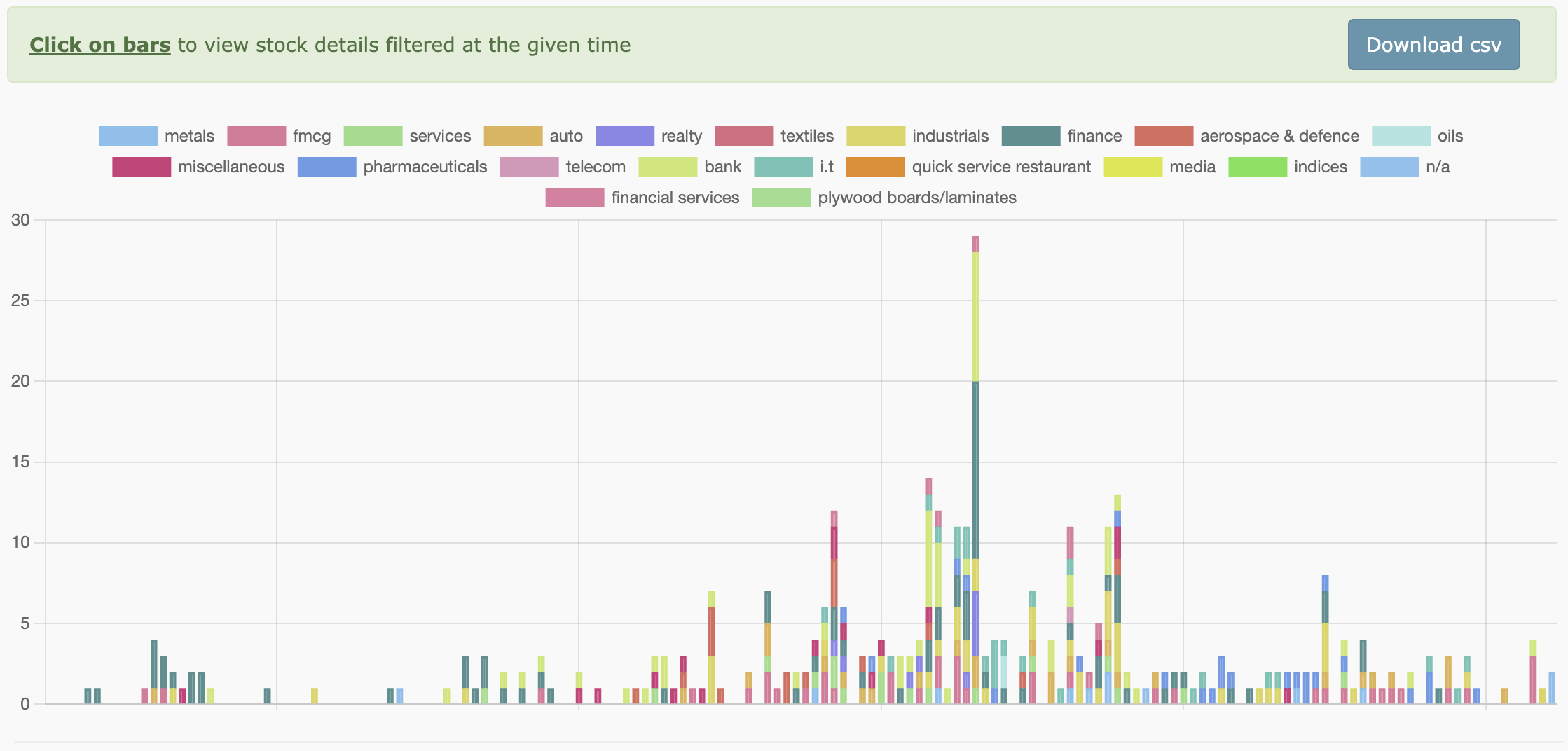

Consumption: When Results Become Noise

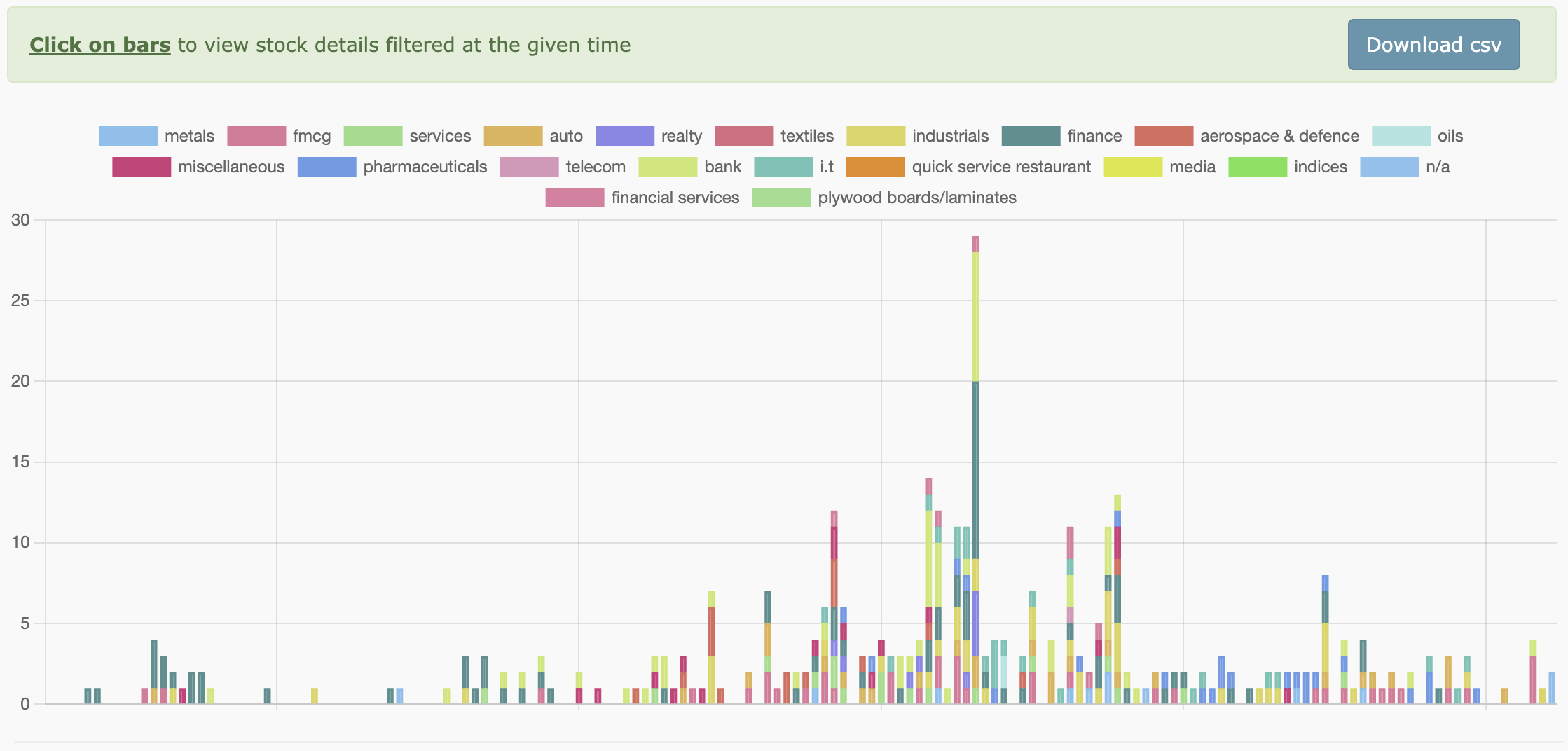

One of the biggest challenges with screener backtests is how platforms present results. They often fall into two extremes: either showing too little or too much. In the first case, outputs are bare-bones, offering little more than a list of tickers or raw distributions that are almost impossible to consume (like the example chart below).

On the other end, some platforms bury traders under a mountain of statistics - returns, drawdowns, win rates, volatility curves - that look impressive but are overwhelming without proper context.

Backtests can indeed generate a rich set of insights, but the responsibility of making sense of them ultimately lies with the trader. Knowing which signals are actionable and which are just noise is often the hardest part. Many traders either get lost in the detail or cherry-pick metrics that confirm their bias, leaving the real lessons untapped.

The good news is that this problem is far more solvable today than it once was. With modern analytics, AI, and thoughtful UX design, the burden of sifting through endless reports can be reduced dramatically. The trader still has to make the final judgment, but the process does not have to feel like searching for a needle in a haystack.

If these pitfalls are so well known, why don’t most platforms tackle them? The short answer: there’s little commercial incentive to do so.

For brokers and mass-market screeners, volume beats accuracy. Their business models thrive on getting more traders to transact, not necessarily on ensuring every trade is grounded in rigorous analysis. Simplified backtests and flashy win-rate stats are often “good enough” to attract retail traders, even if the depth of insight is lacking. Building tools that help fewer, more sophisticated traders make better decisions doesn’t scale nearly as profitably as catering to the masses.

Second, analysis while trading is still maturing. Most traders don’t yet know exactly what they want from advanced backtesting. Markets evolve quickly, retail adoption is uneven, and the definition of “actionable insight” varies widely depending on style, timeframe, and risk tolerance. Platforms therefore default to generic features rather than attempt the harder task of deeply tailoring analytics.

Third, the data and computation challenge is non-trivial. Accounting for things like intra-candle peeking, corporate news, or stock-specific exit conditions requires expensive data feeds, storage, and engineering. For most platforms, the cost of delivering this level of precision outweighs the potential revenue from the relatively small pool of traders who would value it.

The result is a landscape where most traders are left with either oversimplified visuals or overwhelming detail - and the responsibility of separating the signal from the noise rests squarely on their shoulders. Until demand shifts or niche players prove the business case, analysis backed trading will be a market that will never be fulfilled.

In our next blog, we’ll explore how Tradomate is redefining analysis-backed trading, tackling these pitfalls head-on and making features like screener backtesting more practical, reliable, and usable for everyday traders.